Creators are some of the most independent entrepreneurs. If you’re a creator, you’re also the CEO and CFO of your own business.

As an entrepreneur, you’ll find that the innovative ways that creators can make money come with new challenges around managing finances. Instead of a regular bi-weekly paycheck, creator income can come from multiple revenue streams and is often fractured and lumpy.

A 2022 report published on Influencer Marketing Hub shows over 8 potential sources of creator income—this can make tracking income complicated, fast.

The risks of not tracking finances for creators are high. You might find yourself unprepared to pay taxes, and risk having to pay more than you planned. You might realize an invoice is outstanding and the brand never paid because you didn’t follow up. And on a strategic level, if you don’t know what’s coming in, you can’t make a plan for growth or personal budgeting. You’ll leave money on the table because no one will advocate for your financial goals if you don’t.

Just because creator careers might be seen as “non-traditional” doesn’t mean you should be in the dark about managing your finances. This is your guide for how to track your income as a creator so you can master the business side of your creator work. Read on to learn more about these three tactics:

- Set up the right bank accounts

- Track your business expenses

- Use tools to help you work smarter, not harder

Set up the right bank accounts

You’re making money from your creator work—nice! Now you need a place to put it, and being strategic about this will save you a ton of time and money.

Some of your creator income will need to be set aside for taxes, some of it might need to be set aside for business expenses, and of course some of it will be spent in other ways. The best way to manage this is by setting up different bank accounts based on what you plan to do with that money. It’s a more secure and reliable system of putting cash in different boxes.

How many bank accounts do creators need? Business creator @caitlinjenco on TikTok recommends 2-3.

Jenco recommends creators set up these three accounts:

- Primary checking account for holding and spending money

- Secondary checking account for receiving money

- Savings account to put money aside for taxes and business expenses

You can open these accounts through any FDIC-insured bank, or check out platforms like Mercury or Creator Cash that cater specifically to creators and entrepreneurs.

Track your business expenses

The boundaries between personal and professional lives for creators can get messy. But finances are the one place you should draw a hard line in the sand where your personal finances end and business finances start, because it will actually save you money in the end.

Separating your business expenses from your personal expenses not only helps you budget what is needed for your business, it ensures you’re prepared when tax season rolls around. Business expenses can be deducted from your total earnings when you report your income for tax purposes. This means that business expenses are a creator’s best friend.

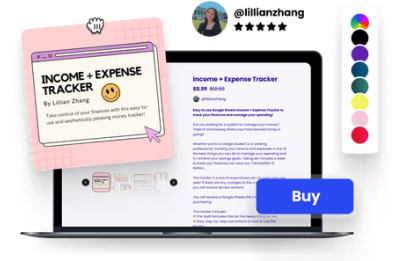

It’s important to track these accurately in real time so you don’t miss any savings opportunities. You can purchase expense tracking templates to make this easier for yourself, like this one from Notion for example.

Retain documentation of each business expense. Depending on what kind of expense it is, this could be:

- Cash register tape receipts

- Documents reflecting proof of payment/electronic funds transferred (if you pay anyone for business purposes)

- Account statements

- Credit card receipts and statements

- Invoices you sent

You might be surprised at what kinds of expenses can actually be classified as business expenses. Some examples of business expenses include:

- Equipment and props for creating content

- Travel and food expenses related to content creation

- Software and editing tools for creating content

- Administrative tools for running your creator business. That’s right—Beacons’s Entrepreneur plan is a business expense!

- Payments to employees or subcontractors

- Commissions and affiliate fees (such as platform transaction fees you pay on product sales)

- Website hosting fees, domain names, and digital ads

- Your cell phone bill (if you run your business from your phone)

- Professional development, including courses and ebooks

- Shipping and postage on merch or physical products sold

TikTok creator @prettycritical points out that you should only be categorizing expenses as business expenses if you are making money from your content.

As a former tax consultant, this creator has excellent advice for how her experience applies to creators. Check out her content if you have any questions about whether your expenses fall into a gray area.

Use tools to work smarter, not harder

When you’re a business of one, you are a limited resource. Your time literally is money! Finding ways to automate repetitive or administrative tasks by relying on tools will free up your time to focus on the things you like most—creating content.

When it comes to tracking your income, manually inputting and crunching your income each week and month is tedious and time-consuming. This is a perfect task to automate. You can set up a smart spreadsheet with formulas to sum your income across different sources. If you’re handy with Excel you can set this up yourself, or download a template from a platform like Notion. When you’re setting this up, consider your income across all potential income sources:

- Brand deal payments (when invoicing brands, you can further automate by having a consistent system for invoicing brands and using tools like Beacons Invoicing and W-9 Generator for creators)

- Consultations, calls, coaching sessions, etc.

- Courses

- Product sales (both digital products and physical merch)

- Tipping and donations

- Creator funds from platforms

- Ad monetization

- Subscription revenue

- Affiliate revenue

However, this still involves manually inputting your income into your tracker.

Alternatively, you could use a tool like Beacons’s Income Dashboard, which automatically syncs and classifies your different income streams by securely connecting to your bank accounts.

You’ll get personalized insights on how to optimize your income based on your unique data. This takes care of input and analysis of different income streams from month to month—two birds, one stone!

Keep up with income tracking throughout the year

Tracking your finances is actually a lot easier than it might sound. The number one thing that will help you is to stay on top of your tracking throughout the year.

Freelancers (including content creators) need to pay taxes on a quarterly basis. Instead of scrambling at the last minute every few months, jot down your income and outflow on a weekly or even daily basis. A few minutes each day or week will save you time and money—you’ll be thanking yourself later.